Articles Of Interest

Articles Of Interest

2021

- 1. First Aid Central - Delivering Innovation in Canada's First Aid Market

In January 2020, Acme United entered the Canadian first aid market through the acquisition of First Aid Central (FAC).

Based in Laval, Quebec, Canada, FAC produces and sells a complete line of first aid kits, refills, and safety products that cover all personal and industrial needs as well as provincial and federal regulations.

What makes this acquisition so attractive - next to the financial aspect - is the fact that FAC holds a valid Medical Device Establishment License issued by Health Canada. This requirement helps to ensure that certain regulatory requirements and procedures are in place with regards to the medical products that FAC offers in Canada. This license is hard to obtain and truly opens many doors in Canada for Acme United.

We were fortunate to speak with the founder and previous owner of First Aid Central, Mr. Tony Kourebeles. This is his story.

The Early days

After working a few years at L'Oréal Canada, Tony Kourebeles left the giant beauty company in 2007 to co-found First Aid Central. At first, FAC, which was based in Montreal, Quebec, was merely a distributer of first aid kits. But soon, Kourebeles and his partner switched from buying first aid kits from another company to actually sourcing and assembling the kits themselves.

They received the necessary permits from Health Canada, bought all the raw components & equipment needed and put the first aid kits together. What immediately made them stand out in the industry, was their ability to provide a customized solution from start to finish to customers. If clients wanted specific styles or colors, or kits in nylon, plastic or metal, or they wanted their logo printed on the kits, that could all be provided in-house by FAC.

Next to the creative side that really helped kickstart FAC, customers who wanted to buy a first aid kit also had limited options before FAC entered the market. They could buy a product that was imported from the U.S. or abroad, but as far as Canadian made products the supply was limited.

As a result, FAC was able to attract quite some attention from early on. In fact, it landed the Canadian Red Cross as one of its first customers, to which it supplied first aid kits, survival kits, and emergency preparedness kits.

Growing Online Presence

After the move to Laval, FAC launched an online webshop on which it sold its first aid kits and related supplies. Ten years ago, having an online presence wasn't as common as it is today. Yet, it quickly became the company's main growth driver.

First Aid Central also tried selling its products in the U.S. market. It soon became clear however how complex it was to meet FDA requirements. In fact, the company spent so much time trying to manage the regulations of moving product across the border, that it was not fruitful and very difficult to operate the U.S. business. As a result, FAC ceased selling products to the U.S. in 2010 and has fully focused on the Canadian market since then.

Focus on Retail Clients Until

Despite having some larger clients, FAC mainly sold directly to consumers for their first aid needs at home, in their car or on vacation. The main reason being that it's very difficult to break into the industrial market.

That all changed when Acme United acquired FAC early 2020. Acme immediately started leveraging its multinational accounts that it had in the U.S. Moreover, Acme Canada had plenty of relationships with large industrial and retail groups for its cutting and office supplies. It already had a foot in the door with those organizations, and could expand its offering with Health Canada approved first aid products.

While customers have become bigger at FAC since the acquisition, the company was able to maintain its roots from back in the day when it started. It still buys all the components and assembles them in-house in Laval, which gives them the ability to deliver products very fast. In addition, the company still differentiates itself by customizing its kits to clients' specific wishes. First Aid Central today employs over 30 people and sells all across Canada and continues to offer exceptional products and service.

2020

- 1. Acme United Dividend Policy

Acme United Provides Smallcap Investors A Rare Opportunity For Dividend Returns

Acme United Corporation is a rare find on the stock market. It trades at less than $100 million market cap yet has been consistently paying out a dividend since 2004. As most microcaps are high-growth startups, they cannot pay out a dividend while incurring operating losses and burning cash. Even as they turn profitable, these companies often reinvest free cash flow back into the business in order to accelerate growth rather than pay back shareholders.

However, while ACU’s market cap is small, its business model of supplying cutting, measuring and safety products to consumer, health and industrial markets is mature and profitable. So in that aspect it resembles more like a DOW company than a typical microcap stock. ACU can afford a steady reinvestment of a portion of its free cash flow into product innovation or marketing initiatives, while still having plenty left over to pay a robust dividend.

The Company’s financials have been on an uptrend over the years. ACU has seen a modest 2.2% increase in revenue growth for the first nine months of 2019. But it has also seen an increase in excess of 10% for both its operating profit and net income for the same period. This greater profitability ensures that ACU’s dividend will remain stable or increase for 2020 and beyond.

Acme’s Total Return Over the Past Ten Years Has Been Enhanced By Its Consistent Dividend

ACU started the past decade with a $9.20 stock price and ended it at $23.79. This is a solid 159% capital gain over ten years. However, the Company also paid a $0.05 quarterly dividend back in 2010. That has steadily increased by a penny approximately every six quarters to a $0.12 per quarter dividend now. ACU has paid out a total of $3.54 worth of dividends to shareholders of record from January 2010 to today. This has resulted in a total return of 197%. Having a consistent dividend in addition to capital gains drastically improves the total return experienced by long term investors in ACU.

The good news with a microcap that pays a dividend is that shareholders aren’t purely relying on market sentiment to experience a return. No one can predict the demand for, and therefore the price of, ACU stock at a certain point in time. However, one can be reasonably assured, based on the history of dividend payouts and increase in earnings, that ACU will be paying a minimum $0.12 per quarter going forward with the strong likelihood of further steady increases.

This will not be dependent on hype or sentiment surrounding the stock. Because of the dividend, ACU shareholders have at least experienced a 1.7%-2.0% annual return over the last three years as a reward for holding a company that is able to achieve profitable growth.

Acme’s Dividend Will Likely Increase For The Foreseeable Future

We previously mentioned ACU’s year-over-year financial improvement for the first nine months of 2019. That has led to a $1.32 diluted EPS for year-to-date Q3 2019, up 18% from a $1.12 diluted EPS for year-to-date Q3 2018. ACU has so far made three dividend payments of $0.12 each for a total of $0.36, up 9% from $0.33 in the previous year.

The Company has a pattern of increasing its dividend per quarter by a penny about every 6 to 7 quarters. They look to ensure that earnings and cash flow are growing in excess of the dividend payments.

2019

- 1. Follow-Up Interview With Rick Constantine

Q: It's been a few years since we conducted our initial interview with Rick Constantine. So it's high time to get an update on some of Acme United’s most popular brands. Rick, can you first describe your responsibilities at Acme United?

A: I am responsible for Camillus, Clauss, Cuda, DMT and Western brands. That includes managing the team of brand managers and looking after the new product development, sourcing, P&L, quality, sales, advertising and promotions.

Q: Let’s go over the brands that you manage for Acme United. First of all Camillus, which is one of the oldest and best known knife brands in the United States. Camillus continues to be a solid contributor to Acme’s financial results. What’s the secret behind its success?

A: Yes, Camillus has experienced incredible growth over the last 5 years. The growth is attributed to keeping our eye on our consumer, providing them with outstanding quality and innovation at the right price. We continuously launch products that are very innovative and pay strict attention to the products intended usage and ergonomics. We have a personal attachment to all of our products, and it shows. We only invent, produce and launch knives we would love to use in the field.

Q: At SHOT, the major marketing event for Camillus, many new tools were introduced. How are they performing?

A: The 2019 knives and tools are performing extremely well for sure. We launched nine (9) new products and they are all performing extremely well and have been received by our end users as well. We launched a new Carnivore called the Inject™. It features an all-new larger blade, hard case and a trimming knife that is stored inside the handle. We also launched the Pocket Block™ which is a small pocket-based multitool. Continuing on with our focus on Bush crafting, we launched our new Bushcraft folding knife featuring Sandvik steel and a micarta handle. We also collaborated with Darrell Ralph on a spectacular new folding frame-lock knife with VG10 steel and carbon fiber handle. You can see all of the new 2019 designs on our Camillusknives.com website.

Q: With the imposed tariffs on items being imported from China, it’s important to note that Camillus also sells high-end domestically manufactured knives. Can you give some more color on those knives?

A: Yes, the tariffs have impacted Camillus as well as the entire outdoor industry. We are working very hard to discover new factories outside China in order to avoid paying the imposed tariffs. Our search includes the United States of course. We are working with two factories to bring USA Made knives at affordable costs. The knives are still in development so make sure to follow our social media while at Shot Show to see what’s new.

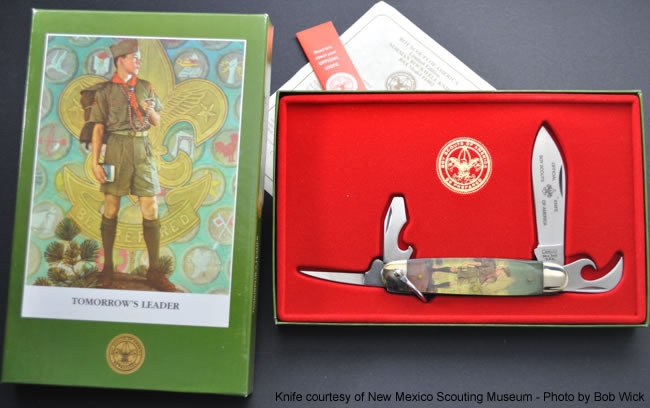

Q: Camillus has recently launched a new Eagle Scout Knife collection. How do you feel about that?

A: Camillus worked very closely with the Boy Scouts of America to build a knife that is well suited for the Eagle Scout. The development took over a year and we launched the knives in 2019. The assortment includes two fixed blade knives and two folding knives as well. They feature high-polished 1070 carbon steel and micarta handles. There is also a custom wood presentation box available. All of the knives, display box and even the packaging was all made in the USA. Camillus has a long heritage with the BSA so it was nice to be their manufacturer of choice once again.

Q: The next brand, and the one which may be closest to your heart as I know you’re an actual US Coast Guard Captain, is the fishing tools brand, Cuda. It sure has been an exciting ride since the brand was launched only a few years ago?

A: It truly has been an incredible 4 years since our launch. To think back and see how the brand has gone since winning iCast is truly miraculous. We grew from 30 products to over 100 now. We are now into landing nets, gloves, harpoons, tool management and more. Cuda is one of those brands that you stand back and look at the amazing growth. We are all very pleased with Cuda’s growth pattern and there is no end in sight.

Q: At ICAST, Cuda’s most important marketing event of the year, you introduced plenty of new tools. Can you describe some of them for us?

A: iCast 2019 was our best show yet. We launched five (5) new products and the most exciting was Cuda’s new Sabiki dehooker. It is a device that, with a pull of a trigger, captures a bait hook, pushes the bait off and then moves down to the next hook. This is an incredible innovation as it is much safer than the existing solution and also allows for the health of the bait as the bait does not need to be touched in the dehooking process. We knew we had a hit when the social media feed hit over 50,000 views in two days. We also launched two new snips that are for smaller hands and also for the fresh water angler. Given all of the Cuda tools that have been launched over the years, we felt that it would be intelligent to launch a tool management system. We worked with the “SeaSucker” company in utilizing their suction cup technology. The result is a spectacular knife and tool holder that attaches to any flat surface using a suction cup so there is no need to drill into your boat. Understanding that more and more fisherman are fishing with chum, we created the Cuda Chum Bag. Our chum bag is tear resistant and also includes a fill and attachment system to make it easy to load the chum in the bag and to attach to a boat as well.

Q: One of the remarkable things about Cuda is the tremendous support it’s receiving from professional fishermen and fishing enthusiasts. The Cuda Pros are really the who’s who of the fishing world. What exactly do they do for the brand and how do you explain their continued support?

A: Our pros are the best of the best for sure. They are crucial in testing each and every tool Cuda launches. Most Cuda tools have a 3 year incubation/test period so I and our pros have the right amount of time to ensure the concept is right and that the tools are constructed properly. This includes the usage and ergonomics. Our pros make their livelihood on the water so understanding their point of view is very important to our future success.

Q: How do you see Cuda evolving the next few years?

A: Cuda will continue to build the very best in innovative tools. However, the brand will continue on its quest to get closer to the fish. Cleaning, filleting, descaling is a necessary part of fishing but it is not the best part of fishing. Catching the fish is the best part. Cuda will continue to focus on getting closer to the fish and integrating the brand into the anglers life from the time they hit the water to the time they come home.

Q: Another brand that performs really well is DMT, the world’s leading innovator of manual diamond sharpening technology. What was the condition of DMT when Acme acquired it in 2016?

A: DMT is a historic brand and known for the most amount of diamond, flattest surface and highest quality of diamonds used in a sharpening device. All of us at Acme are proud that each and every DMT Sharpener is made in Marlborough, MA as well. When we acquired DMT in February 2016, the process in which they made their sharpeners was the finest in the world. We had a hard look at making the plant efficient and that required a great deal of CAPEX investment to bring the factory and its machinery up to date. We wanted to add some automation and the update was completed in August of this year and it included adding 50% more plating capacity. DMT is now operating at its optimum efficiency.

Q: How has the sharpener brand evolved during the past three years and are new DMT products in the pipeline?

A: The sharpener itself is evolving to include more applications such as chain saw sharpening, hunting brad head sharpening, and more. We are looking for a solution for every edge that needs to be sharpened. There is a brand-new line of products coming from DMT that involves using our technology in a different usage from sharpening. I cannot divulge much about the new technology, but it is simply the best new product range in DMT’s 40 year history. The products will launch at Shot Show as well as on our Website and via social media. Stay tuned for more details.

Q: The final brand that we would like to cover is Clauss, which offers a diversified line of cutting tools for the lawn & garden, food service, and hardware industries. What are some of the latest trends in those industries?

A: Clauss is doing very well. The brand is extremely well known in the hardware and industrial segment and we have new technology that will target both segments. First, we are launching the first ever, “Carbide Titanium Shears” called the BlackLine and they will boast the hardest cutting edges on a shear in the market today. This will give the hardware or industrial user spectacular edge retention so they can finish the task at hand without excessive sharpening. We are also launching a brand-new technology in the Food processing/Service segment. Details on this new technology are still confidential but will launch in early 2020.

Q: How does Clauss try to stay one step ahead of the competition?

A: Clauss stays ahead of the competition because we are the cutting experts. Many companies build a variety of products where Clauss concentrates on making the best edges in the market. We also have been building cutting implements for the floral, hardware, industrial and food processing segments and their needs are demanding. Listening to these users ensures that we are building the right products and are task defined.

- 2. Western Knife Brand History

Western Knife Brand History

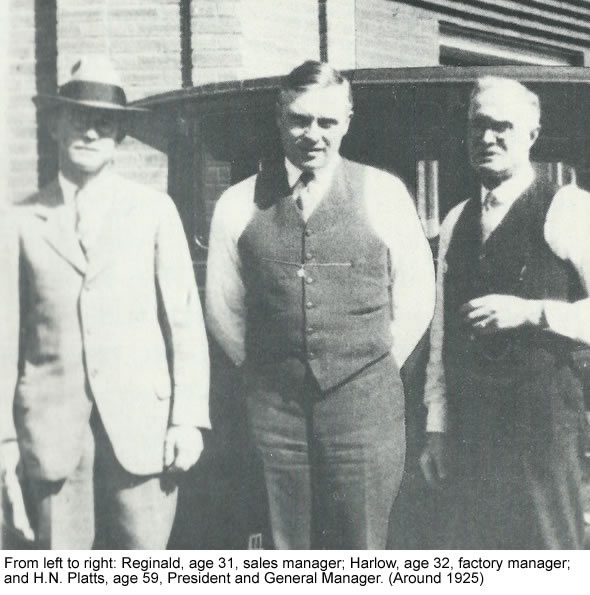

The Western brand's story, and that of several other knife manufacturers, could begin in 1864, the year in which Charles W. Platts emigrated from Sheffield, England. Platts descended from a long line of knife makers and, in turn, his descendants were to have asignificant impact upon a number of U.S. cutlery businesses.

Platts' first employment in the United States was with the American Knife Company in Reynolds Bridge, Connecticut. A few years later, he became superintendent at Northfield Knife Company, located in the nearby town from which the cutlery took its name.

Charles and his wife, Sarah, reared five sons all of whom learned the craft of knife making at Northfield Knife Company. Although other sons and their descendants remained active in the cutlery industry, the focus in this story is on the second son, Harvey Nixon (H.N.) Platts.

After graduating from Eastman Business College, H.N. Platts left Northfield in 1891 and moved west to Little Valley, in Cattaraugus County, New York. There, Cattaraugus Cutlery Company had just begun operations. The owners hired Platts to work in the blade grinding and finishing department of the new knife factory.

The Platts Family Reunited

Also working in the Cattaraugus office was Debbie Case, who lived with her brother, Russ, and their father, W.R. Case. A romance developed, and Debbie Case and H.N. Platts were married in 1892. Within a couple of years, they had become parents of two sons, Harlow and Reginald.

Due to a shortage of water power in Connecticut, Northfield Knife Company had to temporarily close its doors in 1893. When news of this closing reached Little Valley, Cattaraugus Cutlery quickly hired Charles Platts as factory superintendent. H.N. Platts welcomed his father, and brothers in Little Valley as they all began work with Cattaraugus. Practically every department of the Cattaraugus factory now had a Platts family member at work.

The coming together of Charles Platts and his five sons in one factory resulted in the inevitable: they decided to start their own cutlery business. Their plans were ambitious, as they immediately started manufacturing knives without going through the then typical first step of a jobbing operation.

In 1896, the six men formed C. Platts & Sons Cutlery Company in nearby Gowanda, New York, which in 1897 moved to new and larger facilities in Eldred, Pennsylvania. In 1900, when Charles Platts passed away, it was H.N. who assumed leadership of the family business. In addition to managerial responsibilities, H.N. served as the key salesman of Platts cutlery products. Ever expanding to new territories, his sales trips took him to Pennsylvania, New York, Ohio, Indiana, Nebraska, and Kansas.

His Very Own Firm

Like many knife grinders of that time, H.N. Platts' health began to decline due to "grinder's consumption", a disease of the lungs caused from years of work with the sandstone grinding wheels. Doctors recommended a move to the dry western states to improve his lung condition.

In 1911, H.N. Platts, his wife, and their two sons, who turned eighteen and seventeen that year, moved to Boulder, Colorado. Accompanying Platts and his family to their new home was a determination to continue his lifetime work in the cutlery industry.

The developing west proved to be fertile ground for knife sales since the cowboys, farmers, miners, and others workers needed quality cutlery to use many times every day. Platts knew the business and he certainly had experience in starting a cutlery factory, but he knew he would have to build up a jobbing business first before undertaking manufacturing.

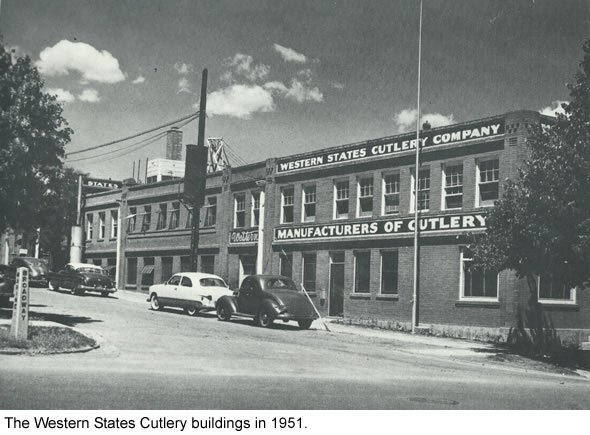

The new business was named "Western States Cutlery and Manufacturing Company". The company though was often referred to as "Western States" or… "Western". The geographical name was given to establish an identity separate from the many knife businesses back east.

H.N.'s connections with the eastern cutlery manufacturers were important though as he sought sources of product. Although Western mainly sold pocket knives, it also offered kitchen knives, butcher knives, razors, scissors, and shears. Manufacturers of all these goods were cutleries like Challenge, New York Knife Company, Valley Forge, Utica, and W. R. Case & Sons.

The Manufacturing Dream

Only two years after the start of his own business, H.N. employed twelve salesmen and annual sales volume reached $50,000. Although the business was prospering and a manufacturing facility would have been in order, it would be several years coming, as World War I had begun and caused shortages of material and labor.

H.N.'s dream was realized however, in 1920 with the opening of his very own factory. The first knife manufactured was a two-blade jack-knife, followed by a Barlow knife. Initially, only the sheath knives were marked with "Western", while all pocket knives received a "Western States" stamp. This continued until the 1950s, after which only the "Western" name was used.

In the early 1940s, H.N. retired from active management of Western States Cutlery, leaving those responsibilities to his two sons, Reginald and Harlow. Pressed into military production soon after the Pearl Harbor attack, Western manufactured a broad range of knives for the military. Western's military knives were issued to field troops and sailors and were essential gear in airmen's survival kits.

At the end of World War II, the factory again commenced producing most of the pocket and sheath knives that it made before the war. In fact, demand for the cutlery's products frequently exceeded its manufacturing capacity. In addition, the Western knives were practically unknown in the East and Southeast of the U.S. due to the factory's limite production capacity.

In 1947, H.N. Platts passed away at age 81. Shortly thereafter, the youngest son Reginald left the cutlery business to pursue a local property management business. In 1951, Harlow Platts and his son, Harvey, reincorporated the company. Almost immediately, production at the cutlery plant was expanded to the maximum and all sales restrictions were lifted, opening up sales across the entire United States. In 1956, they changed the corporate name to "Western Cutlery Company".

By 1957 production had again expanded significantly. As a result, they decided to build a new cutlery 2.5 miles from the old site. Thanks to these improved facilities, the company was able to add many more products to its offering. Western, for example, developed new lines of stainless steel pocket and utility knives, synthetic substitutes for organic components like stag horn, and in 1970 introduced the Westmark custom Bowie sheath knife.

A New Era

Western Cutlery continued to thrive, and in 1978, the business relocated to nearby Longmont, Colorado. The cutlery now housed in a 67,000 square foot building on a 12-acre site to replace the cutlery's former 36,000 square building in Boulder.

Meanwhile, Harvey Platts had become company president and continued in that capacity until 1984, when Western was purchased by the Crossman Air Gun division of Coleman Corporation, thus ending the more than 100-year involvement of the Platts family in the U.S. cutlery industry.

The association with Coleman lasted until 1990, when an investor group in Wyoming purchased the Western knife factory and trademarks. Unable to obtain satisfactory profit performance due to stiff overseas competition, the company's brands, machinery, and tooling were sold to Camillus Cutlery Co. in 1991. In 2007 however, Camillus had to close its doors as a result of bankruptcy due to competition from companies making cheaper knives in other countries. Later that year, Acme United Corp. purchased the product brand names and intellectual property of the company.

Western as Acme United Brand

Less than two years later, Acme re-launched Western at the 2010 National Hardware Show in Las Vegas. The original line included both "Western States" as well as Western branded knives. Today, the brand is doing extremely well at many sporting goods dealers, distributors, wholesalers, e-tailers and retail partners globally.

Acme has continuously launched a mix of historic Western knife designs along with new designs that follow todays trends ensuring the brand remains exciting for its customers and consumers going forward.

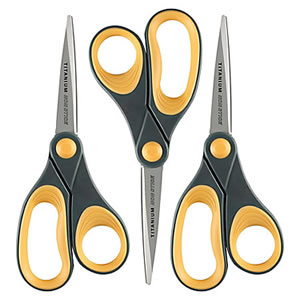

In honor of H.N. Platts and the great men that made Western Cutlery what it is today. - 3. Westcott - The Worlds Favorite Scissors

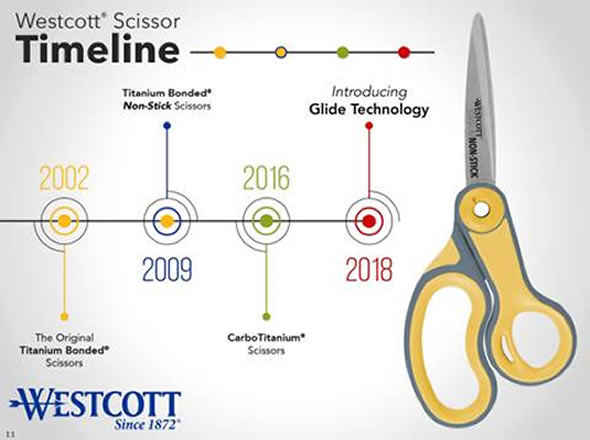

The history of school and office products brand Westcott dates back to 1872, when Henry Westcott, together with his two sons Charles and Frank Westcott, started manufacturing wooden furniture used by printers and trellis units in Seneca Falls, New York.

After remaining in family hands for 96 years, Westcott was sold in 1968 to Acme Shear Company of Bridgeport, Connecticut, which was a manufacturer of shears and medical equipment. Soon thereafter, the first Westcott branded scissors were brought to the market.

Although that business was doing well, the products changed very little. In fact, there was only fractional innovation in the scissors industry worldwide. The majority of scissors had either plastic handles, which were aimed at the lower end of the market, or they were hot forged all steel, which were suited for the high end of the market. There was nothing in between.

THE WESTCOTT REVOLUTION

Late 20th century, Acme United took the decision to change all that and really apply some innovation to scissors.

The Company launched the Titanium bonded scissor in 2002, an innovation that took the whole industry by storm. Mainly because not only scissors manufacturers took notice and tried to copy it, but also other tool manufacturers. Some companies for example, applied Titanium coatings to drill bits. The Titanium bonded scissor really set the pace for Westcott to become the predominant leader in scissors technology across the globe.

In 2009, another evolution was presented to the market, as a non-stick coating was added to the Titanium bonded blades. This made the Westcott scissors very useful in difficult environments like the floral area for cutting and trimming flowers and bushes, or in the arts and crafts area, where lots of glue and paste is used.

Again seven years later, the next generation of Titanium scissors saw daylight. The Westcott CarboTitanium scissors were equipped with blades that had a more durable coating, which was really meant to extend the life of the scissor. The basic goal was to keep the blades as sharp as possible, for as long as possible.

The most recent innovation in the Westcott scissors family is the "Glide" technology. The starting point was to make the mechanism of the pivot point of the scissor as smooth as possible. In order to do so, Westcott used a new cutting edge material, which is strong, durable, and creates very limited friction.

Next to providing almost frictionless movement, the pivot can also be tightened and loosened to whatever tension is required for the item that the user is cutting. The glide scissor will be launched mid-2019. Later, also a non-stick and CarboTitanium version will be brought to the market.

MARKET LEADER

Westcott is the market leader in scissors, and will continue to be in the foreseeable future, thanks to its constant pace of innovation. It comes up with revolutionary ideas to fulfil its customers' needs and wants, and works together with some of the best designers to finalize the designs and features.

The brand has distribution all over the globe, and in fact is now the largest scissor supplier in the world!

2018

- 1. Spill Magic - Conquering the Slip & Fall Market

When Acme United announced the acquisition of Spill Magic absorbents in February 2017, it may have felt like an odd fit for the company's school, home, and office products lines. Learning however that the absorbents were used thousands of times per day in grocery stores to prevent slip and fall accidents, it soon became clear that the products could be perfectly integrated into Acme's safety business.

Spill Magic, Inc, the manufacturer of Spill Magic absorbents and related products, was founded by David Wampler, a serial entrepreneur. In fact, before going into the absorbent business in 1995, he had already owned bars, restaurants and even a construction company.

After seeing a demo of how these absorbents encapsulated all kinds of liquids into a dry powder that could be safely disposed, he was convinced this was going to conquer the dog and kitty litter market by storm.

However, consumers were used to buying a 50 pound bag of clay kitty litter at $5 a bag, while Wampler's absorbent cost $20 for a 10 pound bag. Even though the new absorbent was 50 times more effective than the clay litter, consumers figured that a bigger bag was a better deal.

Consequently, after a few months in business, Wampler changed strategies. He started marketing the absorbent as a safety product to prevent slip & fall accidents. He rebranded the product and removed the word "absorbent" from the packaging and the product's website.

The Slip & Fall Market

The average cost from a slip and fall is $22,800 per accident, while the average workers' compensation claim is $19,000. Slips are not only a problem for employees though. Customers, and even the general public, can also be at risk. If a building occupant or visitor has an accident, medical costs add up quickly.

Knowing that over 540,000 slip and fall injuries, requiring hospital care, occur in North America each year, it's clear that Spill Magic's products are highly needed. Preventing falls from spills saves companies tens of billions of dollars annually.

Spill Magic Birth

With his rebranded product, David Wampler started visiting super market chains. He figured they were the low hanging fruit of the slip & fall market, as jars filled with slippery food items are accidentally dropped on the floor on a daily basis, leaving shoppers at risk. Soon thereafter, he received the first orders from Safeway, Kroger and Walmart.

In 1996, Spill Magic, in tandem with the safety manager at Walmart, developed the Spill Response Program. Under the program, the company would basically sell everything that a potential customer needs to clean up a liquid spill, such as brushes, brooms, dustpans, caution cones, etc.

Spill Magic grew rapidly by introducing its products to numerous retail stores and attending trade shows aimed at retail chains. While revenues in 1995 were only minimal, the next year they already grew to $695,000 and by 1997 they surpassed the $1 million mark. In 1998, sales again doubled to $2.3 million.

Revenues continued to rise in subsequent years, as new clients were added and existing retail chains expanded their use in more of their stores.

While the company's main office was located in Santa Ana, CA, it opened an additional manufacturing and distribution centre in Smyrna, TN in 2013. The main reason to open a second facility was that the absorbents are bulky and light, making them expensive to ship. Consequently, opening the Tennessee facility made shipping much less expensive for the company's East Coast customers. This event again gave a boost to sales. Eventually, the company reached revenues of $6.3 million in 2016.

Spill Magic as Acme United Brand

Soon after Acme United Corporation acquired Spill Magic early in 2017 for $7.2 million in cash, the business was successfully integrated. Marketing support staff was added, which placed the products at major new mass market account, industrial and safety products distributors, online customers, and into the office products market.

Today, Spill Magic continues to focus on B2B customers, such as retail, grocery, restaurant, hotel chains and governmental agencies with the goal of reducing slip and fall accidents in their locations. Its main customers are chains such as WalMart, Publix, Kroger, SuperValu, and Albertsons.

Next to its regular absorbent, Spill Magic offers the Biohazard Cleanup Kit, which is an OSHA compliant solution to safely remove blood and bodily fluid spills.

In addition, the company markets the Hazmat Cleanup Kit, which is a completely customizable kit to safely remove hazardous liquid spills, and also the Acid Absorbent Neutralizer, which is a lightweight high performance absorbent that provides quicker and safer response to acid spills.

As for the near future, Acme aims to broaden its distribution to sectors where the products aren't available yet. For example, the spill pickup products are ideally suited to be used in auto repair shops, where oil, gasoline, transmission fluid, brake fluid, coolants, and solvents present a challenge when spilled.

Finally in Europe, the Spill Magic absorbents have been rebranded to Easy Absorb and will be launched shortly. - 2. SmartCompliance - First Aid Innovation at its Best

For a couple of decades now Acme United is on the forefront of innovation for tools in the school, home, office, industrial and hardware sectors. In more recent years, it also worked its magic for fishing, gardening, and outdoor enthusiasts.

Before 2014, however, the Company struggled with innovation in first aid, one of its major activities. In fact, not only Acme United seemed to be at a standstill, the entire sector still relied on products that had already been around for many years.

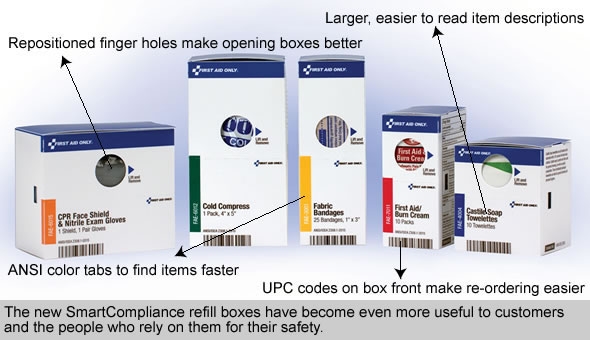

There was one exception to this rule, First Aid Only Inc. (FAO), based in Vancouver, WA had since its founding in 1988, pioneered consultative selling and support of first aid items to large corporate customers, and had since become a recognized industry leader. FAO offered unusual forms and different ways of packaging first aid materials. However, the really big innovation at FAO was its SmartCompliance first aid kits and refills, which made it easy for users to meet regulatory requirements. Acme United felt there was a significant growth opportunity at FAO and acquired the business in June 2014.

INTEGRATING AND EXPANDING THE SMARTCOMPLIANCE LINE

SmartCompliance was the true crown jewel of the First Aid Only acquisition as the cabinets were specifically designed to meet workplace first aid needs. The following components work together to create a very comprehensive solution for first aid supplies in a business environment. Firstly, clearly labeled compartments create a cabinet that is easy to use and restock, eliminating disorganized and missing supplies. The refills come in small boxes. So whenever a box is empty, it can easily be taken out and replaced by a new one.

Secondly, the cabinets are equipped with dispensers that make it hard to grab more than one or two items at a time, reducing pilferage.

Finally, the SmartTab ezRefill system for reordering and restocking revolutionizes replenishment. As supplies are used, the patented SmartTab ezRefill reminder tabs, that are inserted about two thirds of the way into each box,notify users that it's time to reorder supplies. In addition, the SmartTab cards have all the necessary reorder information, making it easy for companies to remain ANSI compliant, while not overstocked.

At the time of the acquisition, First Aid Only had one SmartCompliance model. Shortly after Acme United gained control, it expanded the product line, both in number of models as in the number of components to put in the cabinets. Today, there are about thirty different configurations. Depending on the number of people in an organization and the type of business it is in, FAO has the suited SmartCompliance cabinet.

SmartCompliance's main competitors are the so-called van delivery companies. Their model is very different though. A driver will periodically go to every site to check the cabinets and refill the products that are missing.

This model offers very high service, but also carries a hefty price tag to remain compliant. In today's world, where companies are very competitive and concerned about costs, the van delivery system may have seen its heyday. FAO's SmartCompliance design also meets every workplace's first aid needs, while providing the customer complete control of what to order at a much lower cost.

BETTER AND FASTER WITH THE SMARTCOMPLIANCE APP

The next major step forward for SmartCompliance was the development of the SafetyHub app. Available for both Apple and Android, the application allows requisitions for SmartCompliance cabinets to be saved, placed, and trackedfrom a mobile device or tablet.

New first aid cabinets can be registered through the app, and can be assigned to, and managed by, multiple users. So for example, a user can open the cabinet and check for products that have run out or a SmartTab card sticking out. The user can then scan the items that need replenishing with his mobile device on which the app is installed and send the order to the purchasing director for approval, or directly to the first aid distributor of choice. The app also helps companies to remain OSHA compliant as it clearly shows how often a cabinet is inspected and by whom.

In a recent update, FAO significantly broadened the capabilities of the app. It is now able to track anything in a facility that needs to be either serviced, replenished, or calibrated at certain intervals. For example, the expiration dates of all fire extinguishers in a facility can be uploaded into the app. Subsequently, 30 or 60 days before the due date, the user would get a push notification on the app alerting him to order new extinguishers. This also works for Automated External Defibrillators (AED's) or respirators, in which batteries need to be replaced every so many years.

A new update to the app, scheduled to go live in the fourth quarter of this year, will provide predictive analytics and benchmark consumption of products for its users.

A $1 BILLION MARKET

SmartCompliance revenue is rising fast. Both last year, and so far in 2018, sales showed strong double digits growth. This trend is expected to continue, as the only meaningful competition is the van delivery model, which is more costly and far less versatile than the technology driven SafetyHub app.

Newcomers to the market will face a relatively high barrier to entry and will have to take Acme United's existing and pending patents into account.

As more and more companies understand that they need to become, and stay, OSHA compliant, and can do so at a fraction of the cost of the "old" van delivery model, the choice is obvious. Consequently, First Aid Only and its SmartCompliance cabinets have plenty of room to grow in an estimated a $1 billion US market. - 3. Camillus Follows Up with Century old Tradition as it Launches Family of Eagle Scouts Knives

The Boy Scouts of America (BSA) and Camillus have a powerful history dating back more than 100 years, including the fact that Camillus was one of the first manufacturers of Boy Scouts knives.

The recent launch of the Camillus Eagle Scout Knife collection - the first one since Acme United took over Camillus in 2007 - is very exciting! Not only are these knives display-worthy, they are also made to be used daily in order to "be prepared".

Humble Beginnings

Boy Scouts knives have been around almost as long as the Boy Scouts of America itself. The BSA was founded in 1910, and one year later, the first official BSA knife already appeared on the landscape.

That honor was given to the New York Knife Company from Walden, NY, which had a monopoly to produce the official Boy Scouts knives until 1922. Many of these knives were actually used as giveaways, as in the early years the BSA stimulated sales of its Boys' Life magazine by offering knives as rewards to scouts for getting new subscribers.

Despite there being an official Boy Scouts knife manufacturer, plenty of other knife companies produced knives that were made with the Scout in mind, but were not official BSA knives. These would have names like "Boy Scout", or "Trooper", or "Scout". Amongst those companies was Camillus Knife Co that as early as 1913 had its own 'Standard Scout' knife.

Since that humble beginning, dozens of manufacturers brought hundreds of different varieties of official BSA knives to market. Some were designed specifically for the BSA, while others were versions of regular production knives with the BSA shield added to the handle, or the BSA etching added to the main blade.

Camillus' First Official Knife

It took Camillus until 1946 to receive its first order from the Boy Scouts of America to manufacture a full line of official folding knives.

This is a camp style knife. It is one of the standard BSA models and produced by several different companies. On the bail end, it has two blades. The first one is a combination flat bade screwdriver and bottle opener, while the other is an awl (leather punch). The other end of the knife has the main blade, and a two-piece can opener. The shield is made of raised silver metal, and has the First Class badge on it. The handles are black. Each bolster has a single line stamped into it. This version was manufactured from 1946-1949.

The Camillus Cutlery Company continued to manufacture official Boy Scouts knives for exactly 60 years, until it had to close its doors in 2007. During those six decades, the company produced hundreds of different BSA knives and varieties.

One of those knives that stood out was the Commemorative Norman Rockwell Limited Edition multi-blade folder, which featured a Norman Rockwell scene on one side of the handle, and the Boy Scout Oath on the other. Every year, the BSA selected a Norman Rockwell print to be featured on this particular type of knife.

New Family of Eagle Scout Knives

After noticing a gap in the knife category geared toward Eagle Scouts, Boy Scouts of America's Mike Gerard - an Eagle Scout and former Army Ranger - decided to take action. He sat down with the Camillus team and talked about what earning an Eagle Scout rank taught him about life and how that contributed to his elite military experience.

Eagle Scout is the highest achievement or rank attainable in the Boy Scouting program of the Boy Scouts of America (BSA). The designation "Eagle Scout" was founded over one hundred years ago. Only four percent of Boy Scouts are granted this rank after a lengthy review process.

The teams from both Camillus and Boy Scouts of America made sure that every single part and piece chosen had a solid reason behind it, and that everything could be traced back to the guiding values of Oath, Law, and Motto.

The two fixed blade knives are 8.5" and come with a brown micarta or black G10 handle. The 4" blade is made from 1095 mirror polished high carbon steel and is full tang.

The same high quality steel was used for the 6.75" folding knives. They have a finger flipper opener and a pocket clip. All knives carry a Brass Eagle Scout Emblem inlay in the handle.

Camillus has once again outdone itself as the Scout motto truly applies to this knife set. They are made to be easy to clean and sharpen, so they are ready for every adventure and can be used for anything.

2017

- 1. Westcott Launches Revolutionary Glue Guns for Craft and DIY Markets

Crafting has become a popular activity for millions of adults. The Do-It-Yourself (DIY) movement took off during the recession, and as the economy recovered, people just continued with their crafting habits. It's a steadily growing market.

The Westcott team at Acme United noticed this trend and realized that although it sold products such as scissors and paper trimmers, it didn't have tools specifically aimed at crafters, making it an untapped market.

Early 2016 the team identified glue guns as a sizeable market in the craft and home DIY space, with little product innovation. They concluded that there was a significant opportunity for Westcott to capture a decent share of the market.

So the Westcott people started thinking about which features and benefits the glue guns should have, the color combinations, the sizes, and price points. In other words, they wanted to figure out how to add maximum value to glue guns without adding a whole lot of cost. After all, crafters want an affordable, but quality product.

Product Development Phase

Most new products at Acme United will pass through a series of stages from ideation through design, manufacturing and market introduction. It was no different for the Westcott glue guns.

The first ideas and features were put on paper and sent to the Company's engineering team, which came back with some initial sketches. From there a digital computer model of the product was created, which was altered quite a lot as new features were added and sizes were changed.

Next a prototype was printed with a 3D printer to actually test if the product felt right and if all proportions were correct.

The following stage was engineering and full product development. Here all bits and pieces of the tool were tested to the limit. This is also where third party crafters gave their valuable feedback for some last-minute alterations.

The team decided to initially launch four different products: the revolutionary glue pen, glue guns with high and low temperatures, and glue sticks.

The end products were phenomenal and miles ahead of the competition. They featured non-stick tips, color changing nozzles that tell the user the glue gun is hot, ergonomically designed handles, and in case of the glue gun, an integrated glue stick holder.

To give an idea of how innovative these products are, Acme United filed no less than 15 utility patents for these glue guns, while during the past 20 years all other glue gun manufacturers together filed 4 patents!

Ready for Launch

To launch its new family of glue guns, Westcott is running a campaign targeted at crafting enthusiasts, teachers, and moms. For example, celebrated fashion designer and leading cast member of the Real Housewives of New York City show Heather Thomson, featured the Westcott products on regional TV channels. She did a special on Mother's Day gifts and the Westcott glue guns were one of the items that she suggested.

The entire glue gun family was first placed at Michaels, with distribution shortly following at chains like Rite Aid and Walmart. Next to physical stores, the products are already available at several online stores such as Amazon.com, and Walmart.com.

The tools will most likely become available in Europe and Canada as well.

More Glue Guns in the Pipeline

The arts and crafts markets have been growing in popularity the past few years, so it's only logical that Westcott wants to take optimal advantage of this opportunity.

At this moment, there's a Westcott glue pen and two versions of the glue gun available. In a few weeks a 60 W glue gun version will be launched. This will be a mid-range, more basic product. We understand that several more guns are in the pipeline, which will be launched late 2017, or early 2018. The Westcott glue guns are expected to soon become a multi-million dollar business for Acme United. - 2. Ergo Jr. Scissor Reduces Stress with 50% on Kid's Arm and Wrist When Cutting

In partnership with the United States Ergonomics organization, which specializes in product and workplace ergonomics, Acme United developed the Ergo Jr. The world's first scissor specifically designed with ergonomics, durability and comfort for children in mind. No other company before has spent this amount of time and resources to truly develop a world class cutting product for children.

We were fortunate to speak with Chris Alagno, the Vice President of the Westcott brand at Acme United, to get a feel of how the Ergo Jr. came to live. Chris' background in the tool industry, where he developed easier to use, and more ergonomic, equipment, have helped him to come up with better and smarter tools for school, home, and office use at Westcott.

Part of his job at Acme is to search for problems. Because after all, where there's a problem, there's also an opportunity to develop a product that addresses that issue.

One such issue was observed when kids used scissors. Young children use them very differently than adults, as they pick up the paper that they want to cut. Consequently, they have to arch their hand and arm downwards to cut, which puts a tremendous amount of stress on their hands, elbows and forearm muscles.

The basic problem was that kids had been using scissors for adults that simply had been shrunk down in size.

The solution was to develop scissors of which the blade was angled down so that the stress was removed from their hand and arm when cutting. This helps students, teachers and parents as learning how to cut correctly is part of kids' kindergarten curriculum.

After the initial idea, the next step was to find out what's currently available in the market and what's the opportunity from a sales perspective? It turned out that no ergonomically correct tool for children had ever been designed and brought to the market. Consequently, there's outstanding market potential as each year millions of kindergarten students learn how to cut.

From that moment the search was on to find the ideal angle of the scissor so that kids cut very accurately, while giving them the least amount of stress on their hand. Because Acme didn't have the equipment in-house to conduct all the necessary tests, it partnered with United States Ergonomics, a leading ergonomics organization.

Partnership with US Ergonomics

United States Ergonomics specializes in product and workplace ergonomics. It maintains a state?of?the?art ergonomics laboratory where product testing is performed. Moreover, it is the only company in the United States offering Ergonomic Product Certification.

The project was directed by a Certified Professional Ergonomist (CPE) with over 25 years of product testing experience, who was assisted by experts in biomechanics and physiology.

They really took it to a level where nobody has ever taken anything like this before. No less than 50 kids from ages 4 to 6 participated in the research. They were each hooked up to an Electromyography, a device that measures stress on muscles and predicts fatigue potential.

During many months of testing, the specific muscles, which children use while cutting, were researched. Based on this data, prototypes of the Ergo Jr. were constructed, which had blades with different angles.

The children were called in again to test the different prototypes, and the outcome was astonishing. The new results showed that kids were putting 50% less stress on their muscles while cutting with the Ergo Jr. As they put less stress on their muscles, they were able to cut more accurately and longer without getting tired.

Final Design and Packaging

Once US Ergonomics came back with its final recommendations to improve the scissors further, it was time to engage with an industrial design firm.

Acme reached out to Product Ventures, a firm that already worked closely with US Ergonomics, to design and develop the Ergo Jr. scissors and packaging.

United States Ergonomics basically provided them with a bunch of measurements that detailed the ideal kids' scissors based on all the tests that were conducted. From there the industrial design group optimized an ergonomic fit for comfort, control and accuracy.

Once that part of the process was completed, it was time to call in the manufacturing team.

Conclusion

All in all, this was an extraordinary project for the Westcott team. It took about a year to develop the Ergo Jr., but it was well worth it.

The Ergo Jr. makes life easier for students, teachers and parents, as it enables kids to cut 40% more efficient with 50% less stress on their arms and wrists compared with regular scissors.

In 2016, the Ergo Jr. was exclusively launched at a major retailer, where it sold very well. This year it will be opened up to the entire worldwide market. - 3. CUDA - ACME UNITED'S WORLDWIDE FISHING TOOLS BRAND

In July 2014, Acme United launched an entire line of fishing knives and tools under the brand name Cuda. About 30 tools, specifically designed for inshore, offshore and freshwater fishing, were shown to the public for the first time in Orlando, Florida at the International Convention of Allied Sportfishing Trades (ICAST), the largest sportfishing trade show in the world.

In July 2014, Acme United launched an entire line of fishing knives and tools under the brand name Cuda. About 30 tools, specifically designed for inshore, offshore and freshwater fishing, were shown to the public for the first time in Orlando, Florida at the International Convention of Allied Sportfishing Trades (ICAST), the largest sportfishing trade show in the world.

Right from the start, Cuda aimed to distinguish its tools from the competition by giving them a breakthrough design. For example, the handles were constructed with a transparent poly carbonate, allowing anglers to see that they had a full tang construction.

The tools were also manufactured with German 4116 steel for corrosion resistance and a superior edge retention. In addition, Cuda added a global patented process called Titanium Bonding. This technology treats the steel so that it becomes three times harder than regular steel. Cuda also added materials such as Aluminum & Titanium Alloy and Tungsten Carbide for better performance.

Thanks to these features, the brand was well received by the fishing community and the media. In fact, at ICAST, in 2014, more than 700 tackle products and accessories were entered by 253 companies to win one of the 24 "Best of Show" awards. Cuda also entered the competition in the FishSmart Tackle category with the Grip & Scale tool, and came out on top. A true achievement and a testament of the quality of the new tools!

The tools soon became available at big box and sporting goods stores, such as West Marine, Bass Pro, Cabelas, Dick's and Academy. Consequently, the brand immediately contributed to Acme United's sales.

BIGGER AND BETTER AT ICAST

The International Convention of Allied Sportfishing Trades, better known as ICAST, is the world's largest sport fishing industry trade show. This year, the show celebrated its 60th edition. It hosted 582 exhibitors in 1982 booths covering almost 200,000 square feet of the Orange County Convention Center. The show attracted close to 15,000 attendees, including 1,156 people from 73 countries.

ICAST is the ultimate showcase for the latest innovations in gear, accessories and apparel that help make a day on the water both exciting and rewarding. Keeping up with that tradition, Cuda, since its launch, has introduced numerous new tools at the show.

In 2014, thirty fishing tools, including snips, wire cutters, scale/skin grippers, knives and scissors, were launched. The following year, more than 20 tools were added to the assortment, including a 6" breaking knife, several fillet knives, a knife & sharpener kit, and a marlin spike knife.

Early 2016, no less than six of these tools: the Marine Shear, Flex Fillet Knife, Grip & Weigh, Snip, Small Dehooker, and Dual Plier won a GOOD Design award. GOOD Design is an award from the Chicago Athenaeum, Museum of Architecture and Design, and is one of the oldest and most important design competitions worldwide.

Distribution of Cuda products also expanded abroad, as they became available at the largest fishing chains in Germany, Spain, France, Russia, the UK, the Netherlands and the Scandinavian countries.

At ICAST 2016, Cuda introduced its first ever professional line of knives. The seven different knives featured USA CTS 40A stainless steel blades with titanium-ceramic non-stick Bondings and 47-layer compressed, cold-molded, micarta handles. Also carbon fiber floating gaffs and several freshwater tools such as needle nose pliers, clippers, forceps and a jaw spreaders were launched.

In addition, new items to the accessory line were added, such as a heavy-duty Cuda Sheath & Lanyard, which fits a variety of Cuda pliers and snips; a Cuda Ice Pick; and a Cuda Connect, which connects an action camera, such as a GoPro or WASP to a Cuda Tag Stick or Harpoon.

Moreover, Cuda showed a new series of first aid kits designed specifically for the needs of anglers.

This year, the brand again expanded its product offering with a new line of fishing nets, which integrate a zipper for easy net attachment and removal.

Cuda also launched a line of fishing gloves that meet the needs of both salt and freshwater anglers. Available in three styles - bait, wire wrap and offshore - the gloves are constructed from puncture & cut resistant, quadruple-layer Kevlar. The gloves incorporate touchscreen capabilities so that an angler can operate a smartphone or other electronic devices while wearing the gloves.

Finally, Cuda introduced a premium line of knife and hook sharpeners designed specifically for fresh and saltwater anglers. To meet a wide range of fishing needs, Cuda created three sharpeners - developed in cooperation with Diamond Machining Technology - with grits ranging from fine to extra fine. The entire collection - which includes a bench stone, knife and hook sharpener and cutting board sharpener - features rust-proof construction and is made in the USA. Especially the Cutting Board Channel Sharpener, which fits right on the back edge of a marine cutting board, proved to be extremely popular and convenient.

HAND-PICKED CUDA PROS

A factor that has helped gain the brand a solid name in the fishing community is the Cuda Pro Staff. Right from the start, Cuda attracted several well-known fishermen to help design and test the tools, and to represent the brand.

Bob Izumi, known from the syndicated television show Real Fishing, and three captains seen on National Geographic Channel's hit series Wicked Tuna: TJ Ott, Dave Marciano, and Dave Carraro tested the initial tools for nearly two years before they were released to the public.

Since then, the Cuda Pro Staff has grown to more than 40 ambassadors today. They continue to suggest improvements to prototype tools, so that when they go into production, the products are the best on the market.

Another Pro is Jimmy Johnson, one of the most recognized sportsmen in the US. He is the first person in football history to win a national collegiate title as a player, serve as head coach to a NCAA championship team, and lead an NFL team to two Super Bowl victories.

Next to helping design and develop new Cuda fishing tools, these Pros are true evangelists for the brand. They use the tools at fishing tournaments or on their TV shows and they help spread the word on Cuda on their Facebook, Instagram, Twitter and YouTube channels. All in all, they are very helpful to build brand recognition.

60 MILLION ANGLERS BY THE END OF 2021

60 million anglers in the United States by the end of 2021 that is the goal of the Recreational Boating & Fishing Foundation, which is implementing programs and expanding staff to attract new people into the sport.

Also Cuda is contributing to this goal, as it donates a portion of its net sales to benefit families who might not otherwise be able to "get together and fish". The brand's goal is to bring families closer through fishing and to help educate those who might be new to fishing with helpful tips and techniques from the Cuda Pros.

With 47.2 million licensed anglers today, more Americans fish than play golf (21 million) and tennis (13 million) combined. Anglers generate over $46 billion in retail sales annually with a $115 billion impact on the nation's economy creating employment for more than 828,000 people. An impressive market!

Note that all these figures relate to the United States alone. Cuda, however, is expanding globally, so there is a large addressable market.

CUDA TODAY

Today, Cuda has over 100 different products in its range. Consequently, it's safe to say that Cuda has a tool that will satisfy every freshwater, saltwater, inshore, offshore or river bank angler. - 4. Acme United Celebrating 150 Years Since Inception

This year marks the 150th anniversary of the founding of Acme United Corp. In one and a half century, the Company has become the biggest scissor manufacturer in the world, and a major supplier of cutting devices, hunting and fishing tools, and first-aid products for school, home, office, industrial and hardware use.

The roots of the Company can be traced back to 1867 when German immigrant Leo Renz bought an old grist mill in Naugatuck, Connecticut where he opened Renz Shear Shop, specializing in cast iron shears and scissors.

In 1873, Leo Renz, along with his brother Robert Renz, another family member Mitchell Renz, and John Peck, officially incorporated their business as The Renz Shear Company.

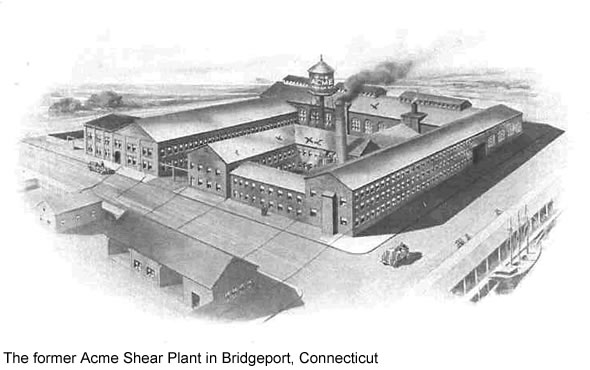

The business continued to grow until in 1878 when Leo Renz passed away. The Company was subsequently sold to Mitchell Renz, who moved the operations to Fairfield, Connecticut in 1880. Two years later, the Company was incorporated as The Acme Shear Company.

Mitchell Renz was also responsible for bringing the brothers David C. Wheeler and Dwight Wheeler into the business. In fact, they bought out Renz, who decided in 1883 to quit the shear making business to try his luck in Florida in real estate.

Under Wheeler management, Acme Shear expanded its product lines. By 1885, it needed more manufacturing capacity and bought 5 acres on Hicks and Knowlton Streets in Bridgeport, CT. The following year, the first scissors were manufactured at the brand new plant. The Company would continue to produce scissors and shears at that same location for 111 years.

Joining The War Effort

Acme Shear grew rapidly, especially when national accounts, such as F.W. Woolworth, began carrying its scissors and shears product lines.

By the end of World War I, production hit historical highs with large shipments to the U.S. Navy, Army, Red Cross, and Emergency Fleet. The Company's exports boomed. By 1920, Acme Shear was manufacturing 35,000 scissors and shears per day, six days a week. Annual volume exceeded 10 million pairs.

In 1923, the plant in Bridgeport, CT again had to be expanded to meet rising demand. In 1936, Acme Shear became the largest scissor and shear manufacturer in the world, a position that Acme United still holds today. In that time, annual production exceeded 15 million pairs.

In 1942, the United States was at war with Germany and Acme once again converted to war work. Dozens of employees enlisted, and a nursery was established to attract mothers into employment.

The following year, production reached an all-time high with over 20 million industrial shears, 22 million surgical shears, and nearly 4 million blunt children's scissors. Production totaled 46 million units during this peak war year.

Medical Field Entered In 1960s

After World War II, production capacity was added to meet growing demand as the United States and Europe rebuilt.

In 1960, Acme Shear acquired Surmanco Ltd, a scissors manufacturer in Sheffield, UK with the goal to sell directly to the European market.

Three years later, Acme purchased the Seneca Novelty Company, a manufacturer of wooden rulers and yardsticks based in Seneca Falls, NY. This marked the beginning of Acme's highly successful sales in the school and office products trade.

In the mid-1960s, Acme Shear began selling disposable medical scissors to hospitals and medical distributors. It later introduced a line of disposable hemostats, scalpels, forceps, and other surgical instruments, and became so successful that a new manufacturing plant in Fremont, North Carolina was opened to meet demand.

Acme Shear marked its 100th anniversary in 1967 and went public on the American Stock Exchange. At that moment, Acme accounted for approximately 75% of the cold forged scissors and 91% of the cast shears produced in the United States. Sumanco produced over half the total cast and forged scissors and shears in the United Kingdom. Combined employment was approximately 800 people, and output reached 50 million units annually.

Acme Shear continued its efforts of diversification. In 1970, it acquired Westcott Rule Company, a major ruler manufacturer, which was founded in 1872 in Seneca Falls, NY. To better reflect the expanded product line, the Company changed its name to Acme United Corporation.

Struggles And Revival

Much of Acme United's growth during the 1970s was due to its thriving medical business. In 1980, Acme United was named Vendor of the Year by American Hospital Supply for its excellence in disposable medical instruments. Sales to that company reached $22 million sales in 1983, representing about half of Acme's revenues.

However, in the late 1980's, American Hospital began manufacturing many of the tools that it previously bought from Acme United itself. In addition, numerous hospitals joined buying groups and began to pool their orders to obtain steep discounts, which resulted in lower margins. Moreover, the Company faced strong new competition from a United Kingdom medical supplier, Smith & Nephew. Consequently, Acme United spent much of the late 1980s struggling.

During the early 1990's Acme United continued to suffer losses, which was reflected in the Company's share price. The stock, which had been trading around $25 in the 1980s, now sold for only $3, leading to strong shareholder pressure to implement significant management changes.

That change arrived in November 1995, when Walter C. Johnsen was named CEO of the Company. He replaced Dwight C. Wheeler who resigned. Johnsen had joined the board of directors earlier in the year to work on strategic focus and the medical business. He had previously been vice chairman and a principal of Marshall Products, Inc., an Illinois supplier of blood pressure units, stethoscopes, and other medical devices. Under his leadership, Marshall became the largest blood pressure unit supplier in the U.S. It was later acquired by Omron Corporation of Osaka, Japan.

After losing more than $8.7 million on sales of $52.2 million in 1995, Acme United initiated a cost reduction program. The Company closed seven manufacturing plants, with production moving to Acme United's more modern, lower cost, facilities in North Carolina and oversees to Korea and China.

Brian S. Olschan joined in 1996 as senior vice president of sales and marketing from General Cable Corporation, where he was a fast-rising executive. He was soon promoted to Chief Operating Officer, and helped transform the Company from an old line manufacturer to one driven by innovation, and customer focus.

During the late 1990s, Acme expanded its North American school, home and office products businesses. As part of its strategic refocus, it sold its medical division for $8.2 million to Medical Action Industries, a Long Island-based supplier of medical and disposable surgical products.

Although the loss of the medical division significantly lowered the Company's total revenues, Acme United returned to profitability, posting net income of $1.1 million in 2000 after losing $156,000 from continuing operations in 1999 and $1.7 million in 1998.

In 2002, the Company introduced the world's first titanium nitride scissors which stayed sharper 3 times longer than competitive products. These went chain-wide at Staples, and soon gained large presence at Office Max, United Stationers, SP Richards, and Walmart.

On An Acquisition Path

In 2004, Acme United reported a 24 percent increase in sales to $43.4 million, while net income grew to $3.2 million. With sales showing improvement in all markets, Acme United had completed its turnaround under Walter C. Johnsen's leadership.

With business once again on an upswing, Acme United was in a position to grow externally. In June 2004, it acquired Clauss Cutlery, a Fremont, Ohio manufacturer of scissors and cutting tools for the floral and industrial markets.

The following years, the Company went on a true acquisition path.

- - In 2007, it bought the brand names and intellectual property of Camillus Cutlery Company, one of the oldest knife manufacturers in the United States;

- - In 2011, Acme United acquired Pac-Kit Safety Equipment Company, a manufacturer of first aid kits for the industrial, safety, transportation and marine markets;

- - The following year, it acquired certain assets of The C-Thru Ruler Company, a well-known supplier of drafting, measuring, lettering and stencil products;

- - In 2014, it acquired First Aid Only Inc., a supplier of first aid kits, refills, and safety products;

- - In 2016, Acme acquired Diamond Machining Technology, a Marlborough, Massachusetts-based manufacturer of sharpening tools for knives, scissors, chisels and other cutting tools; and

- - In February 2017, the Company acquired Spill Magic, Inc., a manufacturer absorbents and related products that are used to prevent slip & fall accidents.

Next to the high number of successful acquisitions, Acme United especially succeeds by applying new and improved materials to everyday products such as scissors, knives and school and office. Some blades will get a titanium carbonitride coating, making them more than three times harder than stainless steel. Or they will have a coating that prevents tools from rusting.

Others will have a non-stick coating, making them useful in sticky environments. Also, some school and office products have Microban antimicrobial protection added during the manufacturing process to prevent the growth of bacteria on the surface.

The combination of Acme's relentless quest for innovation and its ability to acquire companies that fit right into its existing product mix make the Company a big success today.

After 150 years, Acme United is more vibrant and resilient than ever to withstand the ebbs and flows of international business. Walter C. Johnsen commented, "While Acme's history is long, we have built a team of talented associates who I believe can carry us into the future. Our products are well-established, we are growing faster than our competition, and we are earning our sales every day. I look forward to continuing this tradition."

2016

- 1. Update Interview with Georg Bettin, Head of Acme United Europe

It's been two and a half years since the initial interview with Georg Bettin, the Head of Acme United Europe, was conducted. So it's high time for an update about the European segment and its prospects.

It's been two and a half years since the initial interview with Georg Bettin, the Head of Acme United Europe, was conducted. So it's high time for an update about the European segment and its prospects.

Mr. Bettin, in the past few quarters it has become clear that the business is growing in Europe. As a matter of fact, 2016 could become a record year. What are the main drivers for this accomplishment?

Georg Bettin: Over the years we have taken many different initiatives to grow our business in Europe. The main drivers for our growth continue to be our traditional product ranges from the Westcott and Camillus brands. At the same time we are benefitting from the acquisitions of Cuda and DMT. The latter is expected to add about $400,000 to our sales in 2016.

Let's go into a little more detail by discussing each of Acme's brands and categories in which it's active. First, let's talk about the office products channel. The Westcott brand is seeing some significant growth. Can you explain why that is?

Our customers more and more appreciate the service that we offer them. Acme United's global setup seems to be unique in this channel. And our customers are aware that we have our very own division in Asia that is in direct contact with the factories, guaranteeing quality assurance, delivery times, etc.

Because our service is excellent, our customers almost immediately accepted the new office products that we started offering in the past years, such as rulers, pencil sharpeners, clip boards, etc. Also our new sales director, whom we've hired in April of this year, will help us to continue our growth.

Another very interesting development that has taken place since our initial interview is the launch of the fishing tools brand Cuda. Would you elaborate somewhat on the fishing market in Europe.

As for most products, there's not one fishing market in Europe. Each country has its own traditions, specialties and expectations. Despite this given, we are finding a great deal of interest for Cuda in all European countries. The well thought through specifications of the tools, their excellent quality, and attractive price setting are the key selling points of the Cuda family.

The new extension of the range into high end tools and knives is also very much appreciated. We have already established several distributors in different markets and have a lot of leads after the recent EFTTEX show, the largest fishing tools event in Europe.

How has Cuda performed since its launch in the Europe market?

The performance of Cuda in Europe so far is excellent. Customers are ordering more and also the distribution network is expanding. After attending EFTTEX, we believe that we might break through in several other markets as well.

The entire Cuda line was very well accepted by our existing customers as well as by prospects who visited our booth. Consequently, we expect a big boost in sales in 2016, and even more so early 2017 in preparation of the new fishing season starts.

Even some of our mass market customers are interested in promotional activities. This is always a good indicator of the importance of a certain product group.

Acme United Europe recently received its medical certification, which allows it to import first aid products directly from China. Can you clarify this a little bit and what can we expect from it?

Because first aid has become such an important part of Acme United, through internal growth and acquisitions, we would also like to grow this segment in Europe.

Since many years, we supply customers in the first aid industry with bandage scissors. However, to import more first aid products from Asia, we need to comply with ISO 13485 standards, which ensure that the right working processes are in place.

We received the ISO certification early this year and are now in the process of building a product assortment specifically for the European market. First Aid products should become another important pillar for Acme United Europe.

What does the first aid market look like in Europe?

The first Aid market in Europe is still very fragmented. Many countries have different regulations and laws even when they speak the same language. Our first task is to source products, that are universal in all, or most, European countries. That is cost effective and we create as much synergies as possible.

Unfortunately, we can't use the US assortment in this case, because the regulations for first aid products there are again different from the legal requirements in Europe.

How is the Camillus knives brand performing in Europe at the moment?

Also the knife business is very fragmented in Europe. Most knife sales take place in small stores, like tobacco shops in Germany. Therefore the identification of reliable distributors in the various countries is very important and also time consuming. We are making very good progress in countries such as the UK, Germany, Spain, France and Scandinavia. At the same time, we continue to work hard to expand our distribution in other countries.

The final brand that I would like to highlight is Diamond Machining Technology (DMT), which Acme acquired in February 2016. How well was DMT established in Europe at the time of the acquisition and where do you see growth opportunities?

DMT already had a well-established distributor network in several European countries when Acme acquired the company. We are currently working to fill the white spots on the map where no DMT distributor was active yet.

We discovered from early on that DMT customers had a very high interest in Acme's other assortments as well, like scissors and other cutting tools. It's clear that there are lots of additional sales opportunities for us. The outstanding reputation of our brands and the quality of the products support these plans perfectly.

Is it correct that you have started shipping DMT tools directly from Germany to all your European customers?

Yes, that's correct. Since June of this year, Acme United Europe is warehousing all DMT tools in Solingen and is taking care of the delivery of orders to European customers.

Our customers appreciate this excellent new service level as delivery times have considerably shortened and they don't have to worry anymore about the EUR/USD exchange rate.

Talking about the exchange rate, the European segment had a tough time the past couple of years due to the declining euro against the US dollar. Fortunately, that decline has stopped in recent quarters. Were you able to maintain your margins despite the falling euro?